What is a Secured Card and Why Open One?

There are many types of cards out there. Some help your credit. Some don’t. And sometimes taking the wrong action can even hurt your credit score.

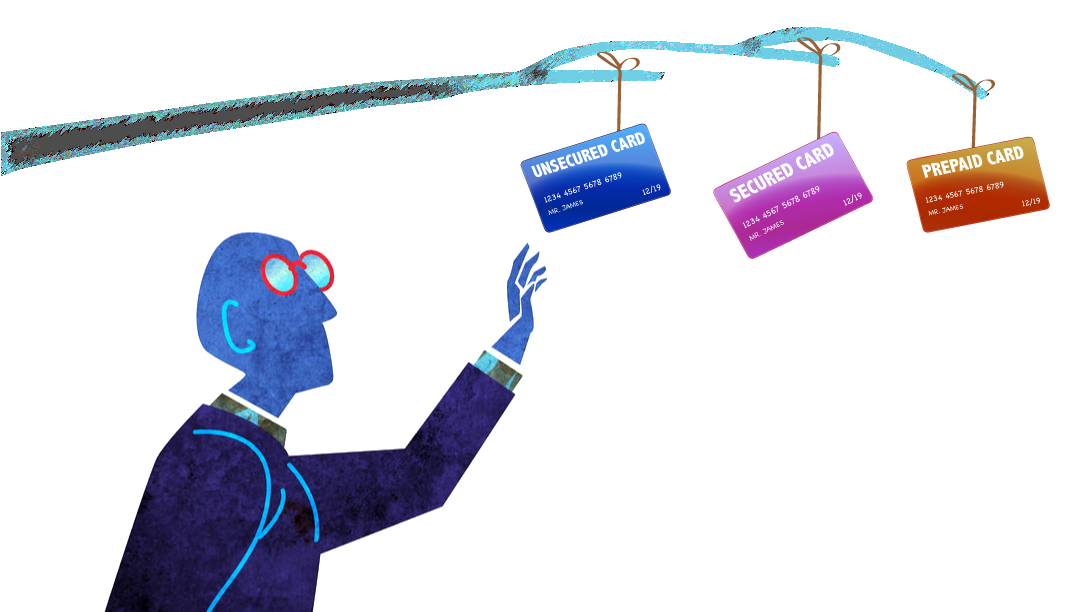

Learning About All the Cards

You may know the different types of cards out there. Secured credit cards, unsecured credit cards, debit cards & prepaid cards. They all look the same and are used the same way, but they are certainly not the same. Debit cards & prepaid cards don’t affect your credit. So, since credit cards are the only ones that do affect your credit, let’s focus on the difference between an unsecured card and a secured card.

“If you don’t qualify for an unsecured card, you’ll probably need to get a secured card instead.”

Unsecured Credit Cards

If you feel your credit is better than average, consider applying for an unsecured card. An unsecured card is the type of card which doesn’t require any initial deposit. Usually, when you’re approved for an unsecured card, you find out how much spending capacity you have. It’s referred to as your “credit limit.” Your creditor determines the amount of your credit limit. They consider your salary, your credit score, and your current credit card debt. If you default on the account (by not making your payments), it’s important to know that the credit card company cannot seize your assets. Their only option (after using collection tactics) is to obtain a judgment and try to garnish your wages or bank accounts.

Secured Credit Card

If you don’t qualify for an unsecured card, you’ll probably need to get a secured card instead. Just like an unsecured credit card, the creditor gives you a credit limit. But here’s the difference: a secured card requires that you put down an initial deposit (which acts as a form of collateral/security). This deposit is held by the bank for protection, in case you default on your payments. Because, guess what? If you don’t make the payment, they’ll take the money from your deposit account.

Advantages of Using a Secured Credit Card

The only reason to apply for a secured card is because you didn’t get approved for an unsecured card. And if you already know your credit is in bad shape, you may want to first apply for the secured card.

Build Your Credit: In either case, a secured credit card is for people looking to build credit. You may want to ask your credit card company if they report to the all 3 Credit Reporting Agencies (CRAs). Some don’t. Building your credit is about making on-time payments. It doesn’t matter if you make payments on a secured card or unsecured card. Both equally help your score.

Since secured cards are backed by a deposit (security for the creditor), most people get approved for a secured card. For those that apply and don’t get approved, there’s usually 3 reasons.

- Have you had any checks bounce lately? Any returned checks get reported to the CHEX systems, which each bank checks before giving out a secured card. If you have any outstanding, unreturned check(s), you’ll probably be denied a secured card until the balance(s) are paid.

- Have you had a Chapter 7 bankruptcy in the last couple years? Many (not all) banks will deny a secured card for this reason.

- Do you have any outstanding judgments showing on your report? Again, many banks use this as a reason for denial.

Get Your Deposit Back: The amount you’re required to deposit is typically equal to the credit limit the creditor gives you. Most secured cards require a deposit between $200 and $1000. After many consistent, on-time payments (usually 12-18 months), you’ll have an opportunity to change the card from a secured card to an unsecured card. If that happens, the creditor will give you your initial deposit back!

Disadvantages of Using a Secured Credit Card

Higher Fees: One disadvantage of secured credit cards is the annual fee that comes with it. Normally, people with good credit wouldn’t want to apply for these cards. They’re really meant for those with no credit or bad credit. Well, for this group of consumers, there’s a higher rate of default. And a higher rate of default means more administrative costs. So, creditors charge these fees to offset those costs.

Annual fees of $50 to $75 are common. And some secured cards even have an application fee and monthly administrative fees. It pays to shop around.

Lower Credit Limits: Credit limits for secured cards are typically pretty low – usually under $1000. Creditors want to see that you can manage a smaller limit before they consider increasing it.

Higher Interest Rates: Many unsecured cards offer interest rates as low as 0-11% for those with good credit. Secured credit cards typically have rates between 18-24%. Either way, be careful not to miss a payment. The interest rate can spike to 30%!