Credit Card Impact – Huge Factor On Credit Scores

High Balances Can Hurt Scores

Perhaps you’ve heard that by paying your bills on time, your credit scores will be fine. But when it comes to credit cards (and other revolving debt), there are 3 things that factor into your scores: (1) Using more than 30% of your overall credit card limit will hurt your scores; (2) Having a lot of credit card debt will hurt your scores compared to other types of debt; (3) High balances on new credit cards hurt scores more than high balances on old credit cards (see inside). Revolving accounts include: credit cards, charge cards, lines of credit, and overdraft protection credit lines.

“IF YOUR RATIO IS OVER 80%, YOUR SCORE CAN DROP BY 60-100 POINTS.”

Don’t Use More Than 30% of Your Total Credit Limits

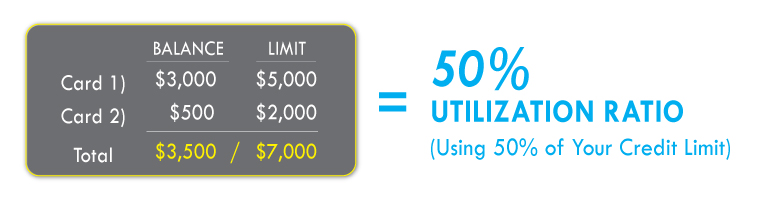

Again, if your total balance (from revolving accounts) is more than 30% of your total credit limit, your credit scores will suffer. Here’s an easy way to calculate your percentage: Add up all of your revolving account balances. Then, add up all of the credit limits. Divide the total balance by the total limit. That decimal number (as a percentage) is your utilization ratio percentage. If your revolving balances equal half of your credit limits (50% utilization ratio), your scores could drop by 20-50 points. Higher utilization ratios are worse. If your ratio is over 80%, your scores may drop by 60-100 points. Here’s a visual example:

“…they’ve heard the myth that having too many credit cards can reduce your score.”

Don’t Close Your Credit Cards

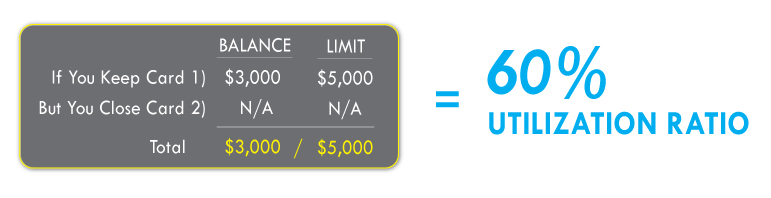

A common mistake people make is paying off a credit card and then closing the account. They do this because they’ve probably heard the myth that having too many credit cards can reduce credit scores. While it’s good to pay off debt, if you close a credit card, this reduces your total available credit limit – which increases your utilization ratio.

Once an account is closed, there’s no longer a credit limit for that account. Using the previous example, you can see how the ratio has increased – which will lower scores:

Solutions to Reduce Your Ratio

Let’s say you can’t reduce your ratio because you don’t have the cash to pay down your cards. Try contacting the credit card issuer and ask them to raise your credit limit. Or, get added to your spouse’s revolving accounts – but only choose the accounts that have significant available credit. Now, this may seem counter intuitive since you’re increasing both your spending capacity and the risk to the card company. However, keep in mind that the credit score calculations don’t consider your risk based on what you could spend…only your total balance compared to your total credit limit.