How do My Balances Owed Affect My Credit Score?

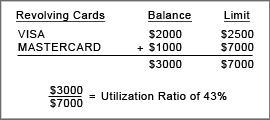

Technically, your utilization ratio is calculated by taking all your revolving accounts (i.e., credit cards, charge cards) and dividing your aggregate balance by your aggregate limit. For example, if you have a credit card with a credit limit of $2500 and another card with a credit limit of $4500, then your aggregate credit limit would be $7000. If the amounts owed on the cards were $2000 and $1000 respectively - totaling $3000 - this would be a utilization ratio of 43% ($3000 divided by $7000).

How Many Cards is Too Many?

The number of credit cards you have does not affect your credit score in a negative way. In fact, it helps it. The more accounts you have to demonstrate your ability to make payments on time builds your payment history… the biggest factor in the credit score equation. Of equal importance is whether the creditors are reporting each month to the credit reporting agencies (CRAs).

If you have a credit card that you haven’t used for a year or more and the creditor has not reported any activity, then that account isn’t helping your score. To help your score, the creditor needs to report each month to the CRAs. Simply using the card and paying it off each month, or carry a small balance, ensures that the account will be reported to the CRAs.

MYTH: Some people have been led to believe that having a lot of available credit limit will reduce your credit score.

FACT: Having a lot of credit available does not affect your credit score. Even if you had a $100,000 credit limit that has a $0 balance… meaning that you could actually go out and spend $100,000 today, has no impact on score. The things that do affect your score are 1) making your payments on time, 2) the length of your payment history on the account - how long you’ve had it, 3) the utilization ratio of your revolving accounts, and 4) the total amount of debt you carry and how long you’ve demonstrated being able to handle the payments.

Think Twice Before Closing a Credit Card Account

A common mistake people make when trying to reduce their debt is paying off a card and then closing the account. While it is good to pay off debt, by closing the card they have also reduced their total available credit limit which affects the ratio calculation. Using the previous example: if you transfer the $2000 balance from the first credit card to the second card that has the higher credit limit of $4500, and subsequently close the first credit card account, then your total balance of $3000 would be on the card with a $4500 credit limit. Your utilization ratio would then be 66%. This higher ratio will have a large impact on reducing your score; possibly by 50 points or more.

One solution to reduce the utilization ratio is to contact the credit card issuer and ask them to raise your credit limit. This may seem contrary to common sense since you are increasing your spending capacity and the risk to the card company, however as mentioned above, this does not affect your credit score. Your utilization ratio does impact on your score.

Note that if you are being charged higher interest rates (over 21%) on a credit card, you've probably paid your bill past the due date or gone over the credit limit. When this happens, the credit card company assigns a higher risk "coding" on your account, which are used in your score calculation. High-risk finance companies also assign a code which indicates to the bureaus that you are a higher risk borrower. This affects your score even though you are never late on your account.

*For all consumers

*For members only

*Coming Soon

Mortgages

- Mortgage eligibility

- Loan to Value

- Mortgage Insurance

- Rent/Leases

Insurance

- Insurance premiums

- Car Insurance

- Home Owners Insurance

- Why it matters

Employment

Interest Rates

- Mortgages

- Automobile

- Credit card

- Store Financing

*For all consumers

*For members only

*Coming Soon

How to Read a Credit Report

- What is a Credit Report?

- The History of Credit Reports

- What Makes Up a Credit Report?

- Credit Reporting Agencies

- How Do Items Get Reported?

- How Long Are Items Reported?

- Serious Errors in Credit Reporting

- Which Inquiries Hurt and How Do They Get on My Credit Report?

- Prescreened Credit Offers

Obtaining Your Credit Report

- Your Right to a Free Credit Report

- How to Obtain Your Free Credit Report

Mechanics of Credit Scoring

Members Only

- Why Credit Scores?

- Who is FICO?

- Fair Issac Corporation Speaks Out

- Credit Card Debt Affects Score

- How Do Inquiries Affect Score?

- Different Types of Scores

- What is a Good Credit Score?

Obtaining Your Credit Score

- Online Vantage Scores Are Insignificant

- Types of Scores That Matter

*For all consumers

*For members only

Credit Management Principles

- How Many Trade Lines Should You Have

- Recentness of Account Activity

- Length of Payment History

- Managing Revolving Debt - Credit Cards & Lines of Credit

- Late Payments – What You Need to Know

- How Inquiries Affect Your Score

- Paying Collections or Defaulted Accounts

- Your Debt-to-Income Ratio (DTI) Impacts Loan Approval

Credit Restoration

- What is Credit Restoration?

- How Credit Restoration Works

- Consumer Dispute Statements

- About Judgments & Tax Liens and Restoring Your Credit

- Comparing Credit Repair Companies

- Rapid Rescoring Can Be A Quick Fix

- Fair Credit Reporting Act (FCRA)

- Fair & Accurate Credit Transactions Act (FACTA)

- Credit Repair Organizations Act (CROA)

Establishing Positive Credit

- Why Establish New Accounts?

- How to Establish New Accounts

- Active vs. Closed Accounts

- When Not to Apply For Credit

*For all consumers

*For members only

*Coming Soon

Debt Validation

Members Only

- The Debt Validation Process

- Prove a Debt Collector is in Violation and Win $1000

- Do's & Don'ts of DV

- Pro's & Con's of DV

- Sample Letters

Debt Settlement

Members Only

- Hiring a Debt Settlement Company - The Fees

- Hiring a Debt Settlement Company - The Risks

- The Debt Settlement Process

- Pro's and Con's

- Do's and Don'ts

- What is Your Best Option?

- Sample Letters

Credit Counseling

Members Only

- How Credit Counseling Works

- Why Most Plans are Bad

- Warning Signs - Tips for Consumers

- When its Appropriate to Utilize Credit Counseling

- How Does Credit Counseling Compare to Chapter 13 Bankruptcy?

- Impact on Credit Scores and Financing Approval

About Chapter 7 Bankruptcy

- What it is

- How it works - rules

- How it works - process

- Should you file for bankruptcy?

- Impacts of bankruptcy on your credit report and score

- Reaffirmation - assets you want to keep

- Common mishaps and selecting a good attorney

About Chapter 13 Bankruptcy

- What it is

- How it works - rules & process

- Should you do it?

- Impacts on credit

- Paying off early

- Compared to chapter 7 - pros/cons

Collection

- How it happens

- Your rights - FDCPA

- Statute of Limitations - by state

- What to do if you are harassed

- Impact on credit

- How they affect mortgage financing

- Paying collections - do's and don'ts

Charge-Off & Profit/Loss

- What it is

- How it works

- Impact on credit score and financing approval

- Affect on mortgage financing

- Paying charge offs - do's & don't

*For all consumers

*For members only

*Coming Soon

Judgment

- What it is

- How it happens

- What to expect and do if you're served with a law suit

- Impact on credit

- Garnishments

- Satisfaction - payoff recordings

- Impact on real estate and mortgage financing

Tax Lien

- What it is

- How it affects financing

- Impacts on credit

- Satisfying/release - get & keep your proof

Child Support

- What it is it?

*For all consumers

*For members only

*Coming Soon

Foreclosure

- What it is

- Impact on credit

- Stopping foreclosure

- Deficiency judgments

- Sample letters

Repossession

- What it is

- How it works

- Impact on credit

- Deficiency judgments